Your cart is currently empty!

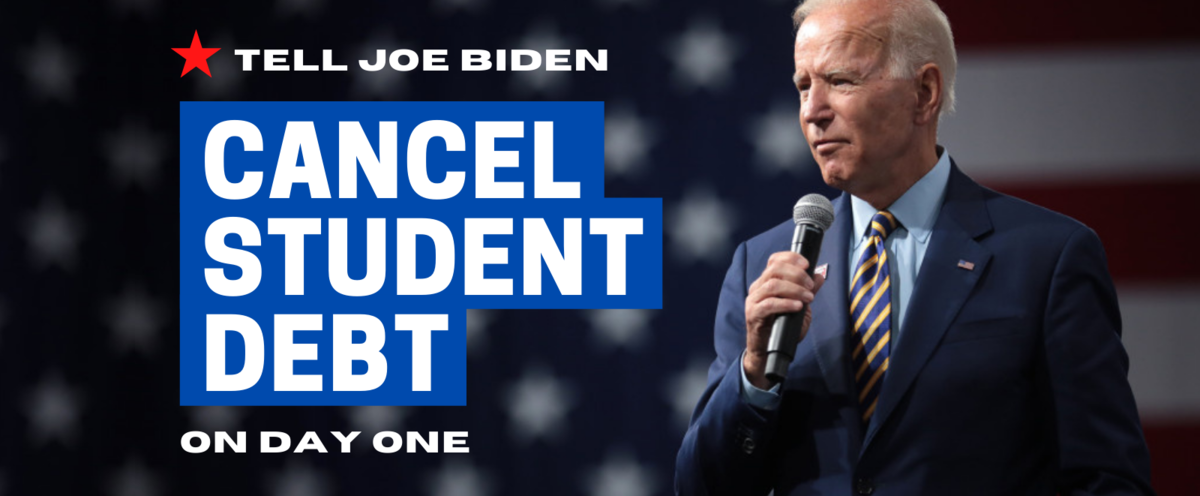

BIDEN SHOULD CANCEL STUDENT LOAN DEBT FOR ALL AMERICANS

|

Getting your Trinity Audio player ready…

|

The progressive wing of the democrat party has been pushing Biden to cancel all or some student loan debt providing much relief to many people who cannot afford to pay back their student loans.

Business – December 12, 2020

(TrueNewsBlog ). President-elect Joseph R. Biden Jr. is facing pressure from congressional Democrats to cancel student loan debt on a vast scale, quickly and by executive action, a campaign that will be one of the first tests of his relationship with the liberal wing of his party.

Mr. Biden has endorsed canceling $10,000 in federal student debt per borrower through legislation, and insisted that chipping away at the $1.7 trillion in loan debt held by more than 43 million borrowers is integral to his economic plan. But Democratic leaders, backed by the party’s left flank, are pressing for up to $50,000 of debt relief per borrower, executed on Day 1 of his presidency.

More than 200 organizations — including the American Federation of Teachers, the N.A.A.C.P. and others that were integral to his campaign — have joined the push.

The Education Department is effectively the country’s largest consumer bank and the primary lender, since 2010, for higher education. It owns student loans totaling $1.4 trillion, so forgiveness of some of that debt would be a rapid injection of cash into the pockets of many people suffering from the economic effects of the pandemic.

There are a lot of people who came out to vote in this election who frankly did it as their last shot at seeing whether the government can really work for them,” said Representative Pramila Jayapal, Democrat of Washington and the chairwoman of the Congressional Progressive Caucus. “If we don’t deliver quick relief, it’s going to be very difficult to get them back.”

Many economists, including liberals, say higher education debt forgiveness is an inefficient way to help struggling Americans who face foreclosure, evictions and hunger. The working poor largely are not college graduates — more than 70 percent of currently unemployed workers do not have a bachelor’s degree, and 43 percent did not attend college at all, according to a reportby the Committee for a Responsible Federal Budget.

While many Black students would benefit greatly from even modest loan forgiveness, debt relief overall would disproportionately benefit middle- to upper-class college graduates of all colors and ethnicities, especially those who attended elite and expensive institutions, and people with lucrative professional credentials like law and medical degrees.

An October analysis by the Brookings Institution found that almost 60 percent of America’s educational debt is owed by households in the nation’s top 40 percent of earners, with an annual income of $74,000 or more.